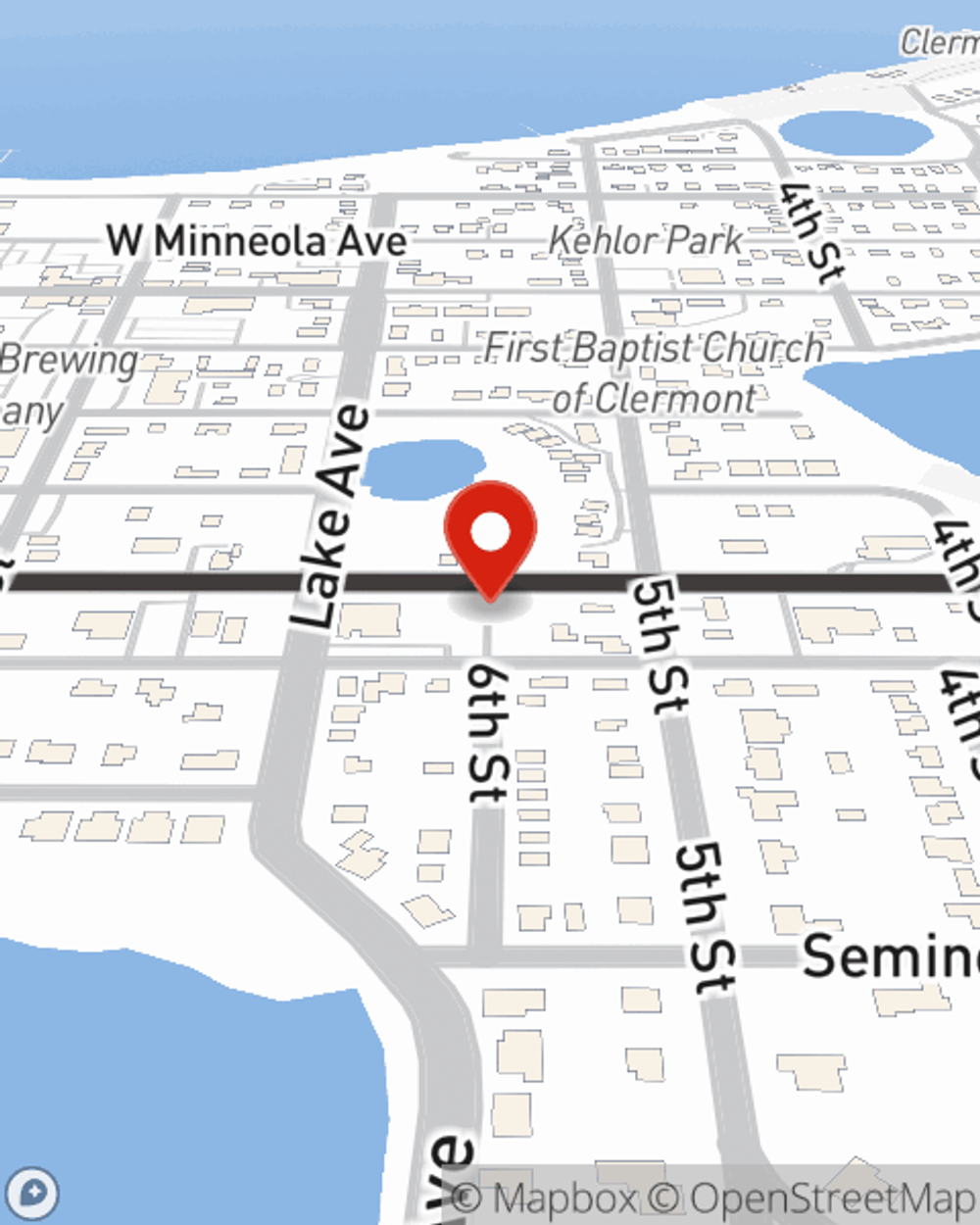

Life Insurance in and around Clermont

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Clermont

- Minneola

- South Lake County

- Groveland

- Oakland

- Winter Garden

- Montverde

- Bella Collina

- Lake County

- Mascotte

- SW Orange County

- Central Florida

- Horizon West

- Four Corners

- Windermere

- Davenport

- Trilogy

- Leesburg

- The Villages

- Ocoee

- SW Orlando

- Hamlin

- Howey in the Hills

- Astatula

Protect Those You Love Most

The typical cost of funerals in this country is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for the people you love to pay for your funeral as they mourn. That's where Life insurance with State Farm comes in. Having the right coverage can help the ones you leave behind pay any outstanding bills and not experience financial hardship.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Why Clermont Chooses State Farm

Some of your options with State Farm include coverage for a specific time frame or coverage for a specific number of years. But these options aren't the only reason to choose State Farm. Agent Heather Thies's fantastic customer service is what makes Heather Thies a great asset in helping you pick the right policy.

Simply contact State Farm agent Heather Thies's office today to check out how a company that processes nearly forty thousand claims each day can work for you.

Have More Questions About Life Insurance?

Call Heather at (352) 394-6933 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Heather Thies

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.